Five years on stock market

Five Years in the Stock Market (2020–2025): What I Learned and What It Cost Me

📌 TL;DR

Over five years of investing, I went from an excited rookie to (at least I think) a more mindful investor. I’ve learned not to overestimate my knowledge, to keep my emotions in check, and not to chase quick profits. Consistency, discipline, and diversification help preserve — and potentially grow — your capital.

- I learned through a hands-on approach, or simply put — learning by doing

- It’s better to invest in your own knowledge than in someone else’s “market signals”

- This journey cost me around 60,000 NOK (in missed profits). On the other hand, not investing at all could’ve cost me roughly 120,000 NOK in missed gains over the same five years

How It All Started: Spring 2020, Lockdown and Charts

May 2020. Everything had come to a standstill — though people hadn’t fully realized how serious it was yet. The pandemic, stay-at-home recommendations, lockdowns.

At the time, I changed employers — I work in consulting — but the project remained the same. Same colleagues, same tasks, just now everything was through TEAMS, without those kafeprat chats or 11:00 lunch breaks. Working from home gave me more space — for thoughts, interests, and, of course, dumb ideas (like: “should I buy some stocks?”).

I started noticing that everyone around me suddenly became an investment expert. YouTube kept suggesting Solodin and similar content. At some point, even my dad casually said, “Maybe it’s time to buy some stocks.” That’s when I remembered that old quote I’d once heard:

When even housewives start investing — it’s time to be careful.

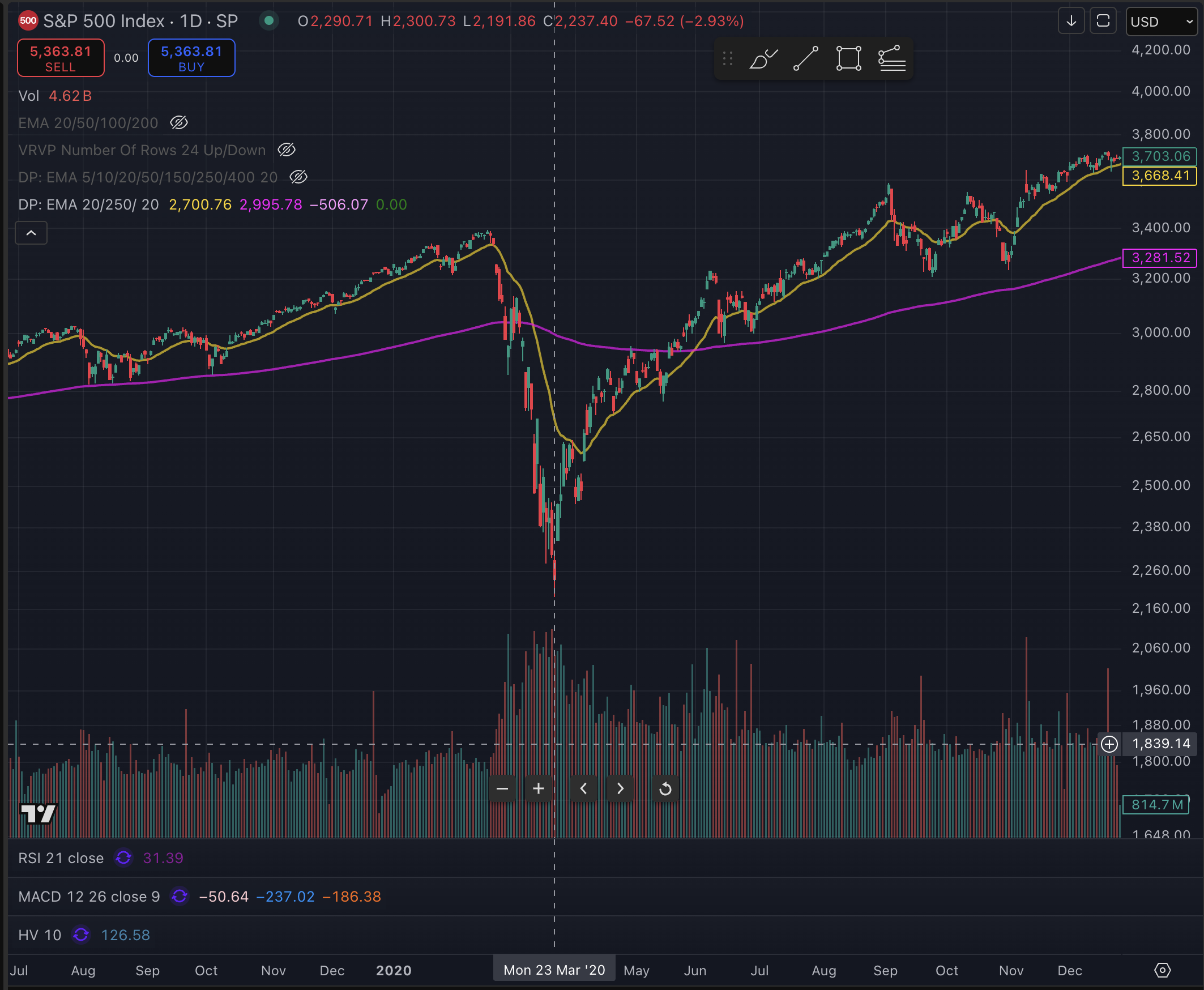

That’s when I opened the S&P 500 chart for the first time.

And there it was — a nice, deep dip from late February to late March.

Naturally, my first thought was:

“If only I had bought in March! I’d be sitting on profits right now and… and who the hell knows what else.”

I think every beginner goes through this. You look at a chart in hindsight — and everything seems easy, obvious, and logical. And yeah, there were plenty of other charts too.

Euphoria, Expectations, and “Brilliant” Moves

Expectations? Ha. I wasn’t even thinking in monthly terms. The plan was simple: buy anything — it’ll eventually go up.

And then just sell. Foolproof logic… Trust me.

In learning, I usually follow the hands-on or learning-by-doing approach — which isn’t exactly ideal for preserving and growing capital.

My head was burning. I felt an urge to buy something, anything, so I wouldn’t miss “the moment.” I had zero knowledge. So I started with what was most accessible — the bank DNB. Everything looked simple: no unnecessary bureaucracy, you could directly invest — no ASK account needed — just transfer from a debit card into their DNB Technology fund.

And so — my first pancake was served. It was a great time: everything was going up just because… and I had no idea why.

Everyone said it would grow — and it did. Of course, I could’ve dug deeper and realized that central banks had printed tons of money, that interest rates were slashed, and that many newbies like me had flooded the market.

But all of that was too complicated for me back then. I could open the DNB Spare app 2–3 times an hour just to see how my funds were doing. It felt like I was on the right track. Or at least, already in the investment boat.

I clearly remember: I didn’t read the terms, didn’t check the fund’s description. At the time it felt unnecessary — the name said it all. Technology? Well, I know tech. So I’m good, right?

Now I sit here… kind of shocked. Does everyone start out like this? The hype hits your nervous system hard, and once you’re in the boat — it doesn’t matter if you’ve got paddles or not — it’s hard to resist. You’re already inside. Already an investor. Already sailing somewhere.

Goals? Just one — to make money. How much? Didn’t matter. Somewhere in the back of my head I had this dream that this new hobby would become a second source of income (I just wanted more work, basically). Heh. Writing this now, I’m laughing.

At that point, I wasn’t thinking about strategies or plans. I just wanted to be “in the game.”

Year One: Emotions, Luck, and Mistakes

In my first year, I was searching for every possible way to invest in Norway. It was something between research, excitement, and chaotic clicking.

Here’s a list of tools I still use to this day:

- Nordnet – a Scandinavian broker with a wide range of investment instruments and integration with Skatteetaten (Norwegian Tax Administration)

- Finansportalen – helps consumers compare financial products and services

- TradingView – charts. Obviously.

- Finviz – free stock market analysis, plus tons of bells and whistles. I check the SPX heatmap almost daily.

- Simply Wall Street – for fundamental analysis. A personal choice — there are plenty of alternatives.

- Morningstar – great for fund screening and data.

- Fidelity: Business Cycle Update – business cycles. Solid theory every investor should understand.

I did some questionable things. For example, I bought into the DNB Technology fund while also picking tech stocks manually.

Did I already mention I never read the fund description? Yeah… I only started doing that recently. 🤦♂️

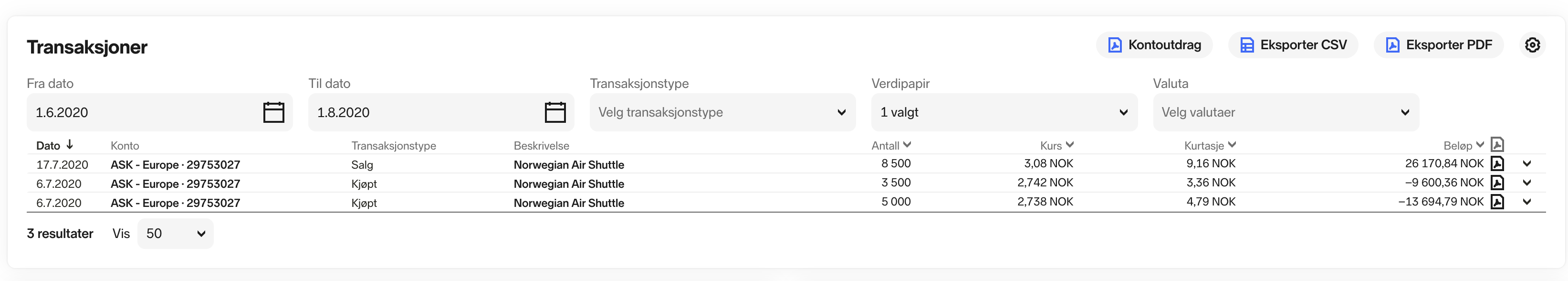

And here’s an example of a “long” position that was pure luck… I made just over 10%, or a bit more than 2800 NOK.

Later, I treated my friend Changiz to McDonald’s while telling him about the trade. (Taxes? Yeah… forgot to mention those.)

Everything felt exciting, cool — and most importantly, it was working.

I had, or so I thought, mastered long positions. Buy and hold sounded reasonable. Especially since everything was going up anyway.

The hardest thing at that time? Selling. I mean, if a stock is going up — why sell? And if it wasn’t going up… I just tried not to look at that red number in the terminal.

In truth, I had no idea when to sell. (Still a topic I think deserves a separate deep dive.)

Sometimes it went like this: I bought a stock, it dropped, then eventually crawled back into green — I’d panic-sell with a +3–5% gain, cross myself, and move on.

Cutting losses? Not a chance. Back then, I just waited, hoped, stared at red numbers, and convinced myself: “Just a little longer and it’ll bounce back…”

Early Signs That Something Was Off

At some point, I started feeling that maybe… not everything was going as smoothly as I thought. It wasn’t anxiety, exactly — but there was a nagging thought: “Am I missing something?”

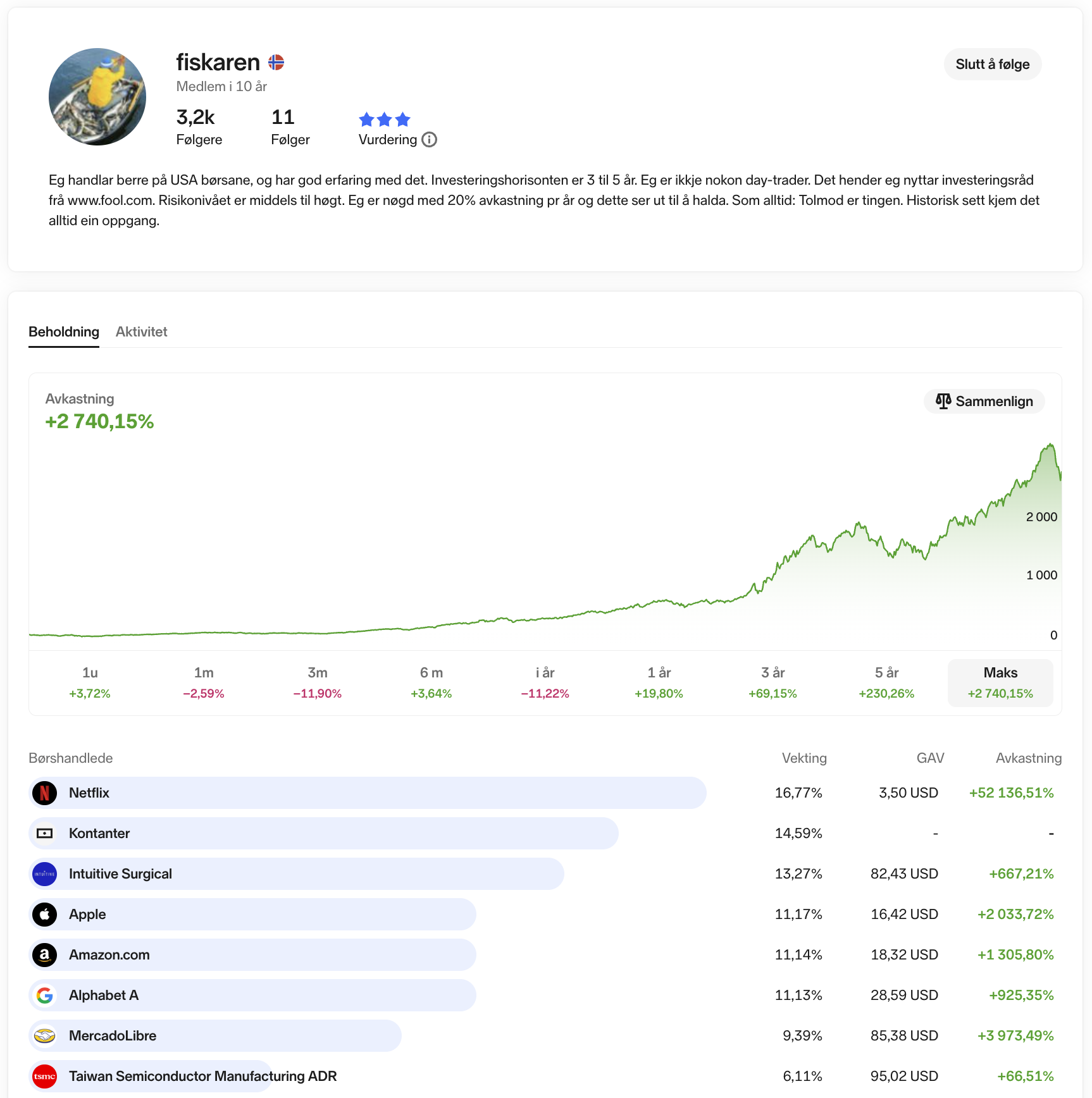

Nordnet has this interesting feature where you can follow other users’ portfolios via Shareville.

Not in full detail, of course, but you can see the relative weight of each holding — which stocks and funds they own and in what proportions. I found myself checking in more and more often.

It seemed like I’d found a few portfolios with undeniably great performance. So I started copying some of their trades. Sometimes that worked. Other times… not at all.

That was my first glimpse of what might be called a “strategy.” Well — if you can call “follow that guy, he looks like he knows what he’s doing” a strategy. The experience was mixed, but it taught me one thing: it’s not that simple. Just buying and holding doesn’t always work — especially if you don’t understand why you’re buying something in the first place.

The only portfolio I still follow to this day is that of fiskaren — in my opinion, it’s one of the best examples of long-term investing done right.

Discipline and Strategy

When Did a Strategy Finally Emerge?

On the main page of Nordnet, there’s a chart that shows your total account performance — the overall return of your portfolio.

There’s also a “Compare with” option, where you can select one or more indexes: like OSEBX (the Norwegian stock market benchmark), DAX (top 40 public companies in Germany), or NASDAQ (which includes around 3,000 mostly tech-heavy companies from the US).

Well… I was underperforming. Still am. Compared to all of them.

I’m not sure the chart reflects absolute numbers correctly — I made a lot of transfers between my brokerage and debit accounts.

That’s when I started digging into how to close that performance gap. The first thing I stumbled upon was index funds with passive management.

That’s when it hit me: Beating the market over the long term is insanely hard. Especially if you’re not a professional and don’t treat investing like a full-time job.

So I started diving into index funds. Each big bank has their own set of offerings — covering different countries, sectors, market caps, and so on. Lots of nuance. But the core idea was simple: It’s better to own the whole market than try to guess the winners.

At the same time, I took a financial deep-dive course by Dmitry Solodin. Tons of valuable lessons:

- Diversification and risk management — the foundations of investing

- Trading tools (which I tend to avoid): shorting, options, crypto (more on that later)

- Planning and strategy

- Budgeting (Excel is immortal)

- The magic of compound interest

I also took a few extra courses on Udemy — not always top-notch quality, but overall they expanded my perspective. I’m still far from an expert, but I started recognizing my past mistakes — and that’s already a solid win.

Overall, I haven’t had any major disasters. Maybe thanks to the knowledge I got in time — and maybe a bit of luck. It was a bull market after all. And the bull forgives a lot.

What I Tried: From Hot-Headed to Systematic

Five years in, I can now say I’ve tried all kinds of approaches — from speculation to moderately mid-term strategies. I’ve started to understand that long-term investing is not about a year or two. Or even five. It’s an ultra-marathon.

Over time, I moved away from short-term trades — anything within a day to a month. It’s exhausting and doesn’t really work in the long run — especially if you have a full-time job and can’t watch the market all day.

✅ What worked (and still works):

- Investing in myself — knowledge, courses, books, observation. It always pays off.

- Doing my own analysis, especially with Scandinavian stocks, where there’s not a lot of public hype or media noise.

- Fundamental analysis works. Slowly, but steadily. Also helps develop patience.

- Investing only what I can afford to lose — one of the most valuable lessons I’ve learned.

- Avoiding things I don’t fully understand, like shorts, leverage, and financial voodoo.

- Diversification — a cash buffer in my bank account, funds across sectors, countries, and currencies.

- Regular, fixed-amount investing — that’s DCA (Dollar-Cost Averaging), and it helps keep emotions and FOMO in check.

❌ What didn’t work:

- Copying other people’s trades. These were my worst investments.

- Hot-headed decisions. Most of my mistakes happened under emotional pressure.

- Averaging down based on emotion, just because “it dropped,” not because I read the reports and believed in the fundamentals.

- Trying to get rich quick. Nope.

Psychology in Investing

This is a big one. It’s dangerously easy to fall into cognitive biases and dive headfirst into some market swamp — while genuinely thinking you came up with the idea yourself. Walking straight into a burning house, thinking it’s a sauna.

📖 A book that gave me a lot of food for thought and changed how I approach decision-making is Thinking, Fast and Slow by Daniel Kahneman

I listened to it in audio format, and I’ll probably reread the physical copy. It made me reflect a lot — and in so many examples, I saw myself, my actions, and my investment mistakes.

No spoilers here — just go read the summary. If you’re investing (especially solo), this book might just rewire how you process information.

Where I Am Now

My head has cooled. Risk diversification is key. Or rather — let’s put it like this: a level of diversification that’s good enough for me, right now, in this stage of life.

No more chasing trains or rockets. I’m aiming for stability and predictability. And ideally — I want investing not to get in the way of life.

Here’s what my current setup looks like:

- Kron — my main platform. “Index” plan (90% stocks / 10% bonds). I invest a fixed amount every month. Most of my capital is here, in passive funds.

- Nordnet — exited to cash in January 2025. What’s left is my employer pension and an IPS account.

- Crypto — small amounts scattered across Binance, Bybit, Firi, and Metamask. More for education than profit.

- Buffer funds — the classic 6-month expense cushion. I had to use it at the start of 2025, now rebuilding it bit by bit.

- Other assets — think “real estate, wheels, and bikes 😄.” Selling two bikes I no longer use. Everything else is unchanged.

- Gold and bonds — knowledge gaps here. I’m learning more now.

Key Takeaways

- I was lucky not to lose money.

- Knowledge is great, but you also need real-world experience.

- It’s more fun with friends — sharing ideas, comparing strategies, and laughing at your “brilliant” trades.

- If you don’t want to spend much time on this — passive investing in index funds is a solid choice. But always read the fund descriptions.

- The more capital you have, the more conservative you become. That’s just me, though.

P.S. Everything described here is based on my own, highly subjective experience.

Your definitions, benchmarks, and approach may differ.

For example, when I say “diversification” and only talk about stocks — someone’s gonna lose it.

But hey, this is my personal level, in my current life stage. And it works — for now.